Market Analysis Review

Weaker than expected U.S. inflation, Fed keeps rates steady, U.S. Dollar weakened, U.S. indices jumped but Dow Jones closed lower. Bitcoin stays low

Previous Trading Day’s Events (12.06.2024)

Excluding the volatile food and energy components, the CPI climbed 0.2% in May, less than April’s 0.3% rise. The core CPI increased 3.4% yearly, the smallest 12-month gain since April 2021, after a 3.6% advance in April. Inflation continues to run above the U.S. central bank’s 2% target.

Peter Cardillo, Chief Market Economist, Spartan Capital Securities, New York

“These numbers show inflation is beginning to move in the right direction, I don’t know if the Fed will take today’s numbers into consideration but obviously it’s a comforting number for the Fed and the markets.”

Fed officials now see a median of four additional rate cuts happening in 2025. That is up from a prior forecast of three.

The 2024 outlook for inflation, sees prices end the year at 2.8% from 2.6% previously as measured by their preferred inflation measure — the “core” Personal Price Expenditures (PCE) index.

FOMC statement asserted that “there has been modest further progress” toward that goal. However, it was noted that they need to see confirmation in the outlook for inflation returning to the Fed 2% target before cutting rates.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 per cent,” the statement read.

Fed Chair Jerome Powell at the press conference declined to offer any guidance on when a first cut could happen. Powell has previously made it clear that, before cutting rates, the Fed will need more than a quarter’s worth of data to make a judgement on whether inflation is steadily falling toward the central bank’s goal of 2%.

The odds of a first cut in September rose following the CPI report Wednesday morning and stayed at 58% following Powell’s comments.

Source:

______________________________________________________________________

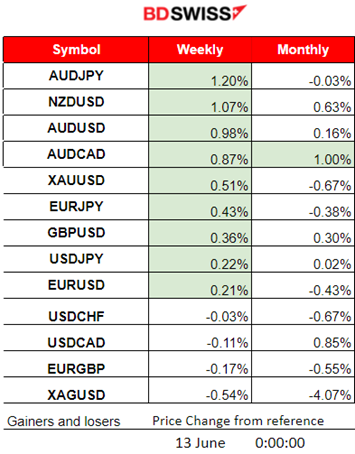

Winners vs Losers

AUDJPY is leading for the week with 1.20% gains so far. AUD pairs (AUD as Base) have reached the top of the list while AUDCAD is leading this month with a 1% performance.

______________________________________________________________________

______________________________________________________________________

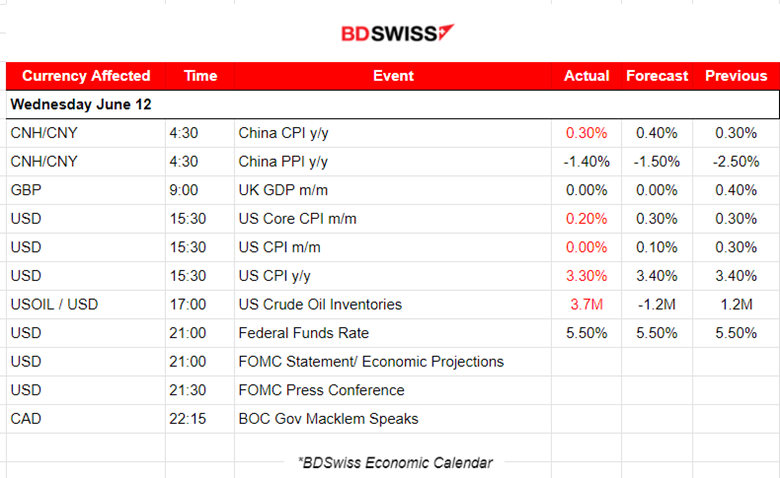

News Reports Monitor – Previous Trading Day (12.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s CPI inflation dropped in May, and PPI declined at a slower pace. CPI rose 0.3% year-on-year in May. Month-on-month CPI inflation shrank 0.1%. CNH saw appreciation, however, and USDCNH dropped at the time of the release.

- Morning – Day Session (European and N. American Session)

Monthly real gross domestic product (GDP) is estimated to have shown no growth in April 2024. GDP is estimated to have grown by 0.7% in the three months to April 2024. GBP saw depreciation and GBPUSD dropped around 10 pips before a full reversal.

At 15:30 the CPI data for the U.S. shook the markets as inflation was reported unexpectedly lower. Monthly calculation dropped to 0% versus the expected 0.10% while the annual calculation dropped by 0.10%, down to 3.30%. After a strong NFP reading people expected at least inflation to remain steady. The surprising news caused high U.S. dollar depreciation. The EURUSD jumped around 85 pips at the time of the release before experiencing retracement.

At 21:00 the Fed announced their decision to keep rates steady for now and stated that economic activity is expanding, labour market conditions remain strong and that inflation has eased, even though it remains elevated still.

The Fed projects that PCE inflation will be at 2.6% and core inflation at 2.8% at the end of 2024. Higher projections than last time.

Powell mentioned that progress in inflation in Q1 had a pause, the takeaway was that it would take longer to get to rate cuts and it did. He declined to offer any guidance on when a first cut could happen. Powell has previously made it clear that, before cutting rates, the Fed will need more than a quarter’s worth of data to make a judgement on whether inflation is steadily falling toward the central bank’s goal of 2%.

The odds of a first cut in September rose following the unexpectedly weak CPI report and stayed at 58% following Powell’s comments.

During yesterday’s session, the dollar index fell by 8 points and then started to retrace, while after the FOMC and Fed decision release, it strengthened a bit more as there is no info to suggest that September is the month that the first cut will take place.

The start of rate cuts could be pushed perhaps as late as December. Officials project only a single quarter-percentage-point reduction for the year amid rising estimates for what it will take to keep inflation in check.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (12.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was not experiencing major activity during the Asian session. After the start of the European session, it started to move to the upside, obviously driven by the USD when it started to depreciate early. After the CPI news at 15:30, however, the pair experienced an intraday shock with an initial jump to the upside near 60 pips, which later extended to near 90 pips reaching to the resistance level at near 1.085. The pair retraced to the 30-period MA and reached the 61.8 Fibo level. The FOMC news and Fed’s statements did not have much impact after 21:00 but only ensured that retracement took place as the USD appreciated, correcting from the jump.

___________________________________________________________________

___________________________________________________________________

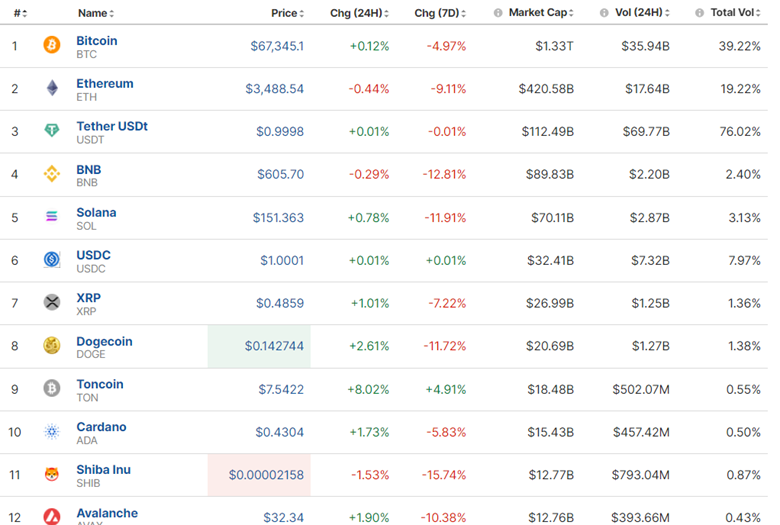

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price had stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily broke resistance levels, 68K, 69K, 70K and lastly 71K. That changed on Friday, 7th of June, with the NFP news release that caused dollar appreciation and bitcoin’s price to crash near 3000 USD. Retracement took place with the price settling at 69.5K USD. After some consolidation that lasted since the 11th of June, the price eventually crashed further, reaching a support near 67,200 USD. As per our previous analysis, the price eventually retraced to the 61.8 Fibo level and settled at near 67.5K USD.

On the 12th of June, the U.S. CPI news caused dollar depreciation and Bitcoin jumped to test again the 70K USD resistance. It was however unsuccessful and reversed to the 30-period MA. Volatility levels lowered but the price returned near the 67K support.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Despite dollar depreciation Cryptos have not seen any significant improvement yet.

Source:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 10th of June, the index moved sideways but with moderate volatility and with several unsuccessful tests for a breakout of the resistance at near 5,373 USD. It was a consolidation phase that was broken to the upside on the 12th of June when finally the index moved higher. At 15:30 the U.S. CPI news caused the index to jump as inflation was reported lower than expected. This gave a hint that interest rates, and borrowing costs, could lower soon. After reaching resistance at near 5,450 USD the index retraced near 5,420 USD and continued sideways.

______________________________________________________________________

______________________________________________________________________

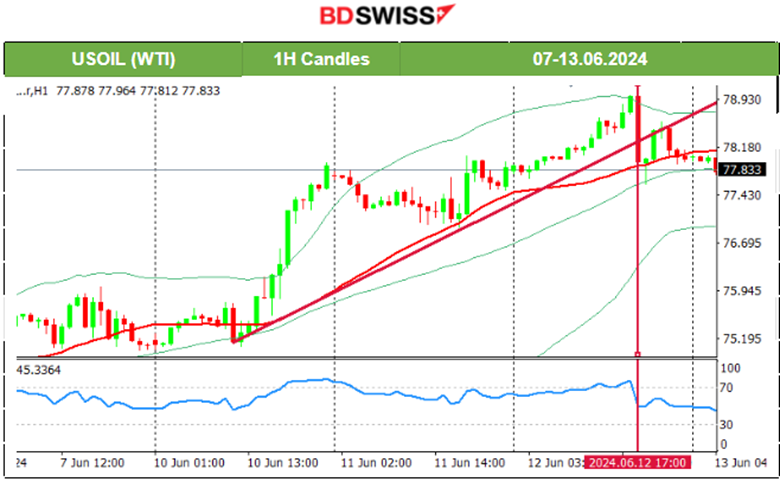

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Hour Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 7th the market experienced some moderate volatility but the price remained stable moving sideways. It settled near 75.4 USD/b. The 76 USD/b resistance level was breached on the 10th of June and the price jumped higher reaching the next resistance at near 77.80 USD/b with retracement taking place. It seems to be a clear uptrend for now. The price managed to reach on the 11th of June at 78 USD/b. On the 12th of June, the resistance mentioned in our previous analysis was broken as predicted and the price moved higher. However, the U.S. inventories report yesterday had actually a negative impact on the price. A huge reading of over a million can cause a drop like that. Obviously the forecast was negative, thus the reaction can also be explained by that fact. Is this a sign of weaker demand though? Technically, that 79 USD level resistance looks like a turning point. We are in the upper band, H4 Bollinger Bands 50 period.

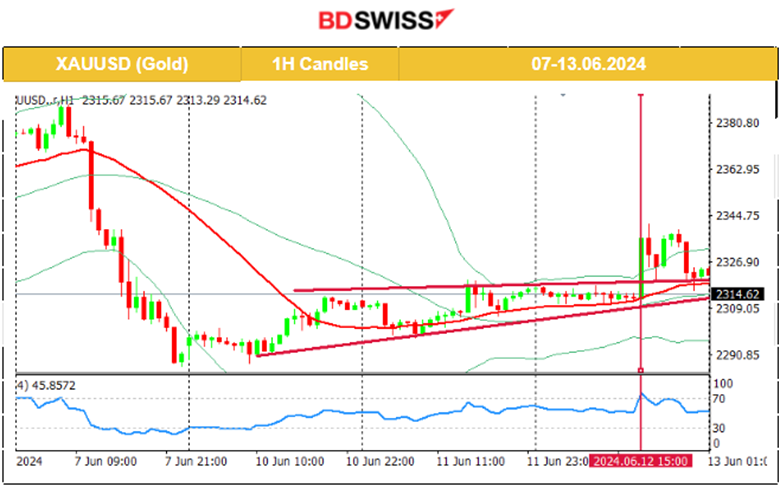

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 7th of June, Gold saw a sudden drop of 20 dollars passing the first support, indicating an uptrend stop. GOLD dropped ahead of NFP on Friday though. Data showed that China’s central bank didn’t buy any Gold last month, ending a massive buying spree that ran for 18 months. Gold’s price had already dropped since 11:00 server time on Friday, near 90 dollars drop for the day. As per our previous analysis, a retracement took place for the price to correct from the huge drop. It even reached 2,320 USD/oz on the 11th of June. On the 12th of June, the U.S. CPI news caused the USD to depreciate and Gold to jump. After a jump of almost 30 dollars, it reversed when it found resistance at near 2,342 USD/oz. The reversal was quick. The dollar had not yet appreciated enough but the reversal started to happen indicating demand perhaps weakening, keeping the metal lower.

______________________________________________________________

______________________________________________________________

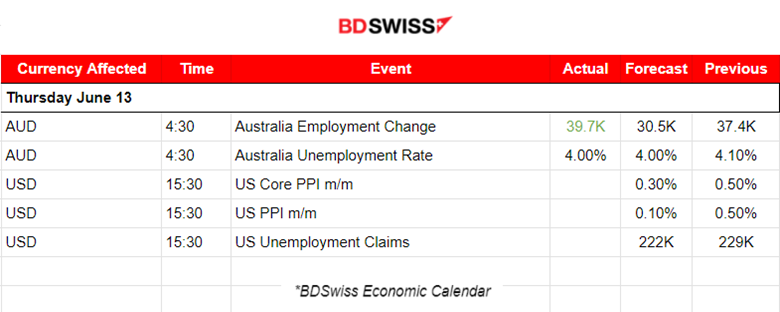

News Reports Monitor – Today Trading Day (13.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s employment change was reported higher than expected at 39.7K versus the expected 30.5K, while the jobless rate fell by 0.10% as expected. These data show how strong the labour market conditions are and indicate that inflation has lower chances of lowering, despite the fact that the central bank raised interest rates in 2023 to 4.35%, keeping it high until now. Policy easing is only likely to begin in the second half of 2025, according to former senior Reserve Bank official Jonathan Kearns.

The market reacted with AUD appreciation but the effect soon reversed, marking a low-level intraday shock. AUDUSD jumped just 12 pips before reversing.

- Morning – Day Session (European and N. American Session)

At 15:30 the U.S. PPI data will be released. Analysts expect lower growth for these which does not coincide with the recent economic data for the U.S. A surprise to the upside could push the USD again higher.

General Verdict:

______________________________________________________________