Market Analysis Review

China missed Industrial Output but beat retail sales expectations, Empire State Manufacturing index improved, U.S. Dollar weakened, Gold dropped, Crude oil and U.S. stocks jumped

Previous Trading Day’s Events (17.06.2024)

______________________________________________________________________

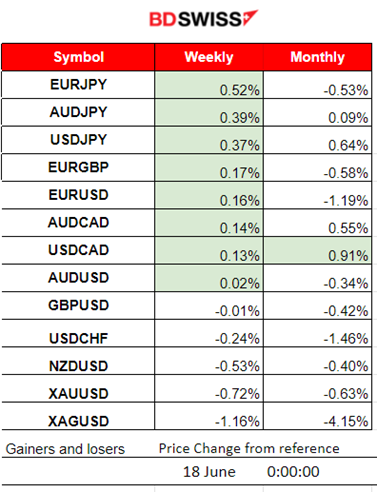

Winners vs Losers

JPY pairs have reached the top with EURJPY leading, having gains of 0.52% this week. USDCAd leads this month with 0.91% gains. JPY is actually losing more ground.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (17.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China in May managed to beat retail sales expectations, but industrial output and fixed asset investment were missed. The Industrial Production figure was reported as lower than expected. Retail sales were reported higher, up to 3.70% versus the previous 2.3% growth. No major impact was recorded in the market.

- Morning – Day Session (European and N. American Session)

The Empire State Manufacturing Index figure was released at 15:30 showing improvement but still negative. There was no special impact on the market upon release. The dollar however started to depreciate steadily after the start of the N.American session.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (17.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was facing low volatility, moving around the 30-period MA during the Asian session. After the start of the European session volatility levels started rising and the EURUSD started to move upwards steadily on an upward intraday trend. The EUR showed some strength during the start of the trend but the USD depreciation later on helped that trend to continue until the end of the trading day. No shock was recorded, thus no retracement took place.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

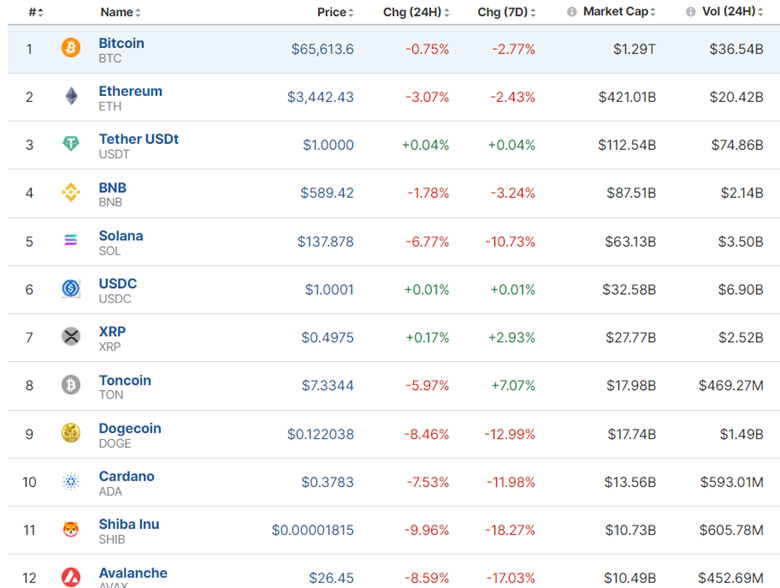

On the 14th of June, after the U.S. news at 17:00, the price dropped and tested the support near 65K USD before it retraced to the 30-period MA. It remained low during the weekend and settled at near 66K USD. When the weekend passed, on the 17th, the market started to get active again and volatility labels rose. The price fell to 65K before reversing to the upside quite rapidly finding resistance close to 67,200 USD before retracing to the intraday mean. Today the price saw a fall reaching a support near 64,500 USD before it finally retraced to the 30-period MA.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

More volatility took place at the start of this week, however, the market is not improving. Prices remain low, a result of the previous week’s decline.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A triangle formation was broken to the downside on the 14th of June and support near 5,400 USD was reached as mentioned in our previous analysis. The index reversed fully after that and it moved slightly above 5,440 USD, above what looks like to be a channel now. The level 5,445 USD acted as a resistance and it was broken on the 17th. The index jumped to the next resistance at near 5,500 USD before a slowdown. Retracement could take place if the level near 5,479 USD is broken with the target level of 5,470 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

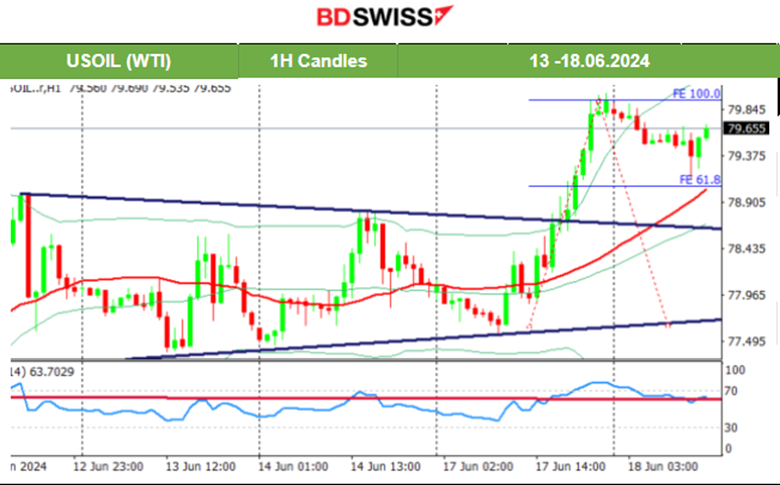

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of Crude oil was in a consolidation phase after a long uptrend. On the 17th the price moved above the 79 USD/b resistance and succeeded in a breakout of the upside, moving quite rapidly and reaching the next resistance at near 80 USD/b. Retracement took place on the 18th with the price returning to the 79.10 USD, 61.8 Fibo retracement level.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 14th of June, the price reversed to the upside and tested the resistance again, at near 2,340 USD/oz unsuccessfully. It reversed back to the 30-period MA and remained on a consolidation path with the mean price at near 2,320 USD/oz. A triangle was formed as volatility levels lowered and on the 18th of June, that triangle was broken to the downside. Currently, the price tests a critical support near 2,310 USD/oz. Breakout to the downside might cause a drop to the next support at near 2,300 USD/oz

______________________________________________________________

______________________________________________________________

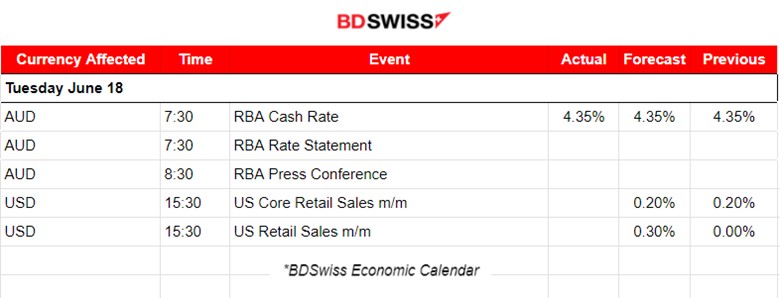

News Reports Monitor – Today Trading Day (18.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 7:30 the RBA announced their decision to leave the cash rate unchanged at 4.35%, as expected. The current rate, the highest since September 2011, has been unchanged since November 2023. Conditions in the labour market eased further over the past month. However, over the year to April, the monthly CPI indicator rose by 3.6% in headline terms. The market reacted with a moderate intraday shock. The AUD depreciated slightly and the effect was reversed quite soon.

- Morning – Day Session (European and N. American Session)

The U.S. core retail sales figures will be reported at 15:30. At that time the USD pairs could see an intraday shock, causing one-sided direction movements that could spark trading opportunities. The NFP report showed a high enough figure to suggest that retail sales growth could see improvement and that is why economists are expecting a rise to 0.3% this time in retail sales.

General Verdict:

______________________________________________________________