Market Analysis Review

U.K.’s labour data raise the bets for a BOE rate cut soon, the U.S. dollar remained strong, Gold and Crude oil closed higher, U.S. indices experienced high volatility but remained at the same levels, Bitcoin slightly corrected from the drop

Previous Trading Day’s Events (11.06.2024)

The figures indicate that inflation may be lowering even further, allowing the central bank to reduce the highest borrowing costs in 16 years.

“The UK’s labour market is slowly weakening,” said Tomasz Wieladek, Chief European Economist at T. Rowe Price. “A rapidly weakening labour market is a strong signal to cut Bank Rate.”

“Average earnings are rising in real terms as inflation falls, but are a staggering £12,000 per year below what they’d be on pre-financial crisis trends,” said Stephen Evans, chief executive at Learning and Work Institute. “This shows the scale of catch-up needed in the years ahead.”

Source:

https://www.reuters.com/article/idUSLDE68E0JH/

______________________________________________________________________

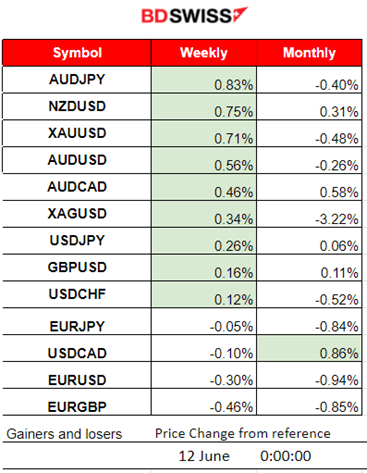

Winners vs Losers

AUDJPY is currently leading for the week with 0.83% gains. This month finds USDCAD on the top with 0.86% gains. The EUR seems to lose ground against other currencies.

______________________________________________________________________

______________________________________________________________________

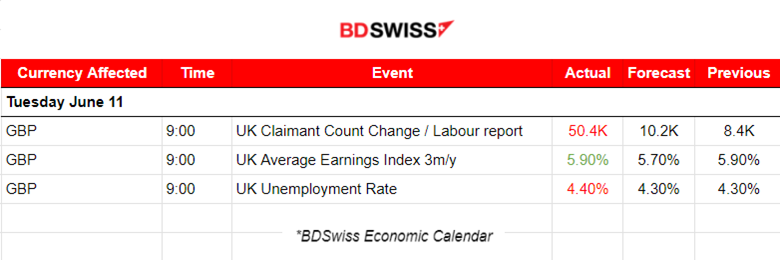

News Reports Monitor – Previous Trading Day (11.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special figure releases.

- Morning – Day Session (European and N. American Session)

The change in the number of people claiming unemployment-related benefits during the previous month was reported way higher at 50.4K versus the expected 10.2K. Unemployment rate rose to 4.4%. The average Earnings Index (3m/y) was reported steady at 5.90%. The figures continue to show signs that the labour market may be cooling, with the number of vacancies still falling and unemployment rising. The market reacted with GBP depreciation at the time of the release. More than 14 pips drop for GBPUSD, reaching near 20 pips drop a while later, before retracing eventually to the intraday mean.

General Verdict:

__________________________________________________________________

__________________________________________________________________

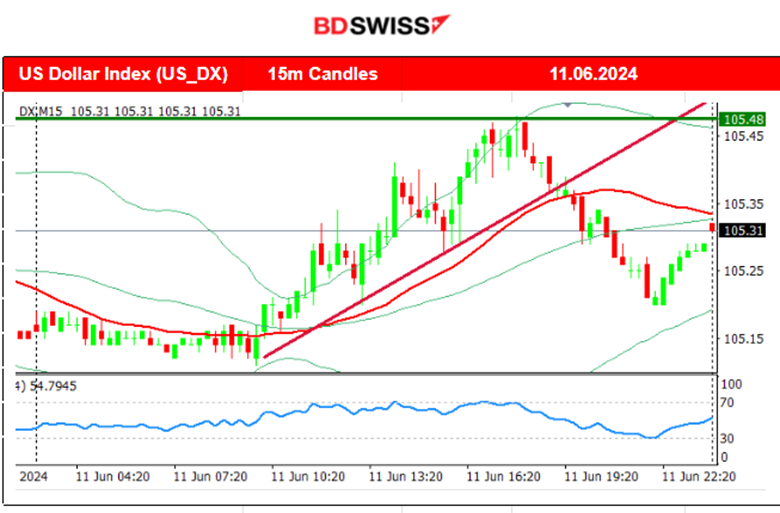

FOREX MARKETS MONITOR

EURUSD (11.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving sideways with low volatility until the start of the European session. Then, it moved to the downside as the dollar gained more strength. That was quite a steady but notable drop. After it found support at near 1.07215 it finally retraced/returned to the 30-period MA and continued with a sideways around the mean. In the broader picture the pair is moving downwards but at a slower pace. The U.S. inflation report as well as, the FOMC and Fed rate decision announcement could change things dramatically.

___________________________________________________________________

___________________________________________________________________

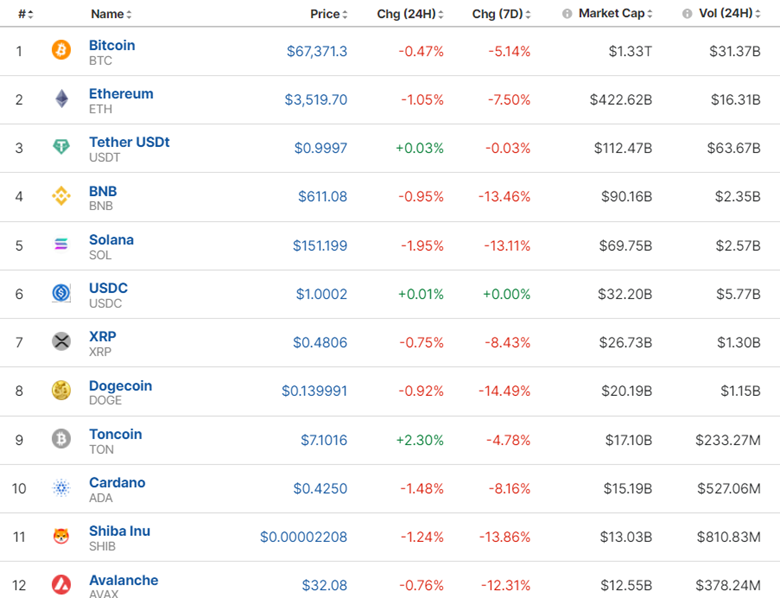

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price had stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily broke resistance levels, 68K, 69K, 70K and lastly 71K. That changed on Friday, 7th of June, with the NFP news release that caused dollar appreciation and bitcoin’s price to crash near 3000 USD. Retracement took place with the price settling at 69.5K USD. After some consolidation that lasted since the 11th of June, the price eventually crashed further, reaching a support near 67,200 USD. As per our previous analysis, the price eventually retraced to the 61.8 Fibo level and settled at near 67.5K USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The Crypto market is suffering after two consecutive declines in Crypto values. The 24-hour and 7-day period columns became red as any gains last month were wiped out. No significant improvement has taken place yet.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The market was quite volatile upon the release of the employment figures for the U.S. on the 7th of June. The dollar appreciated while stocks plunged at that time completing the retracement to 61.8% of the long movement upwards that started on the 4th. The index soon reversed though back to the 30-period MA and remained stable. On the 10th of June, the index moved sideways but with moderate volatility and with several unsuccessful tests for a breakout of the resistance at near 5,373 USD. A triangle formation could be formed at the moment as we approach the day of the CPI releases for the U.S. this week.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

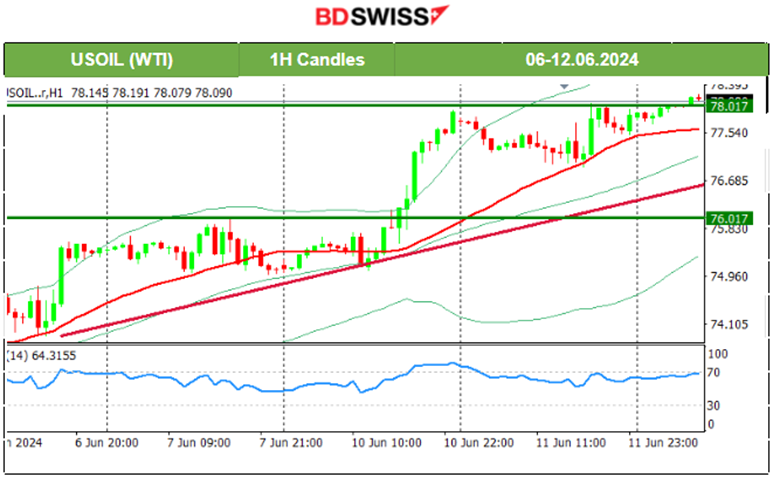

USOIL (WTI) 4-Hour Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 7th the market experienced some moderate volatility but the price remained stable moving sideways. It settled near 75.4 USD/b. The 76 USD/b resistance level was breached on the 10th of June and the price jumped higher reaching the next resistance at near 77.80 USD/b with retracement taking place. It seems to be a clear uptrend for now. The price managed to reach on the 11th of June at 78 USD/b. Even though there is strong resistance there, the price seems to have just breached that with the potential to move higher soon.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 7th of June, Gold saw a sudden drop of 20 dollars passing the first support, indicating an uptrend stop. GOLD dropped ahead of NFP on Friday though. Data showed that China’s central bank didn’t buy any Gold last month, ending a massive buying spree that ran for 18 months. Gold’s price had already dropped since 11:00 server time on Friday, near 90 dollars drop for the day. As per our previous analysis, a retracement took place for the price to correct from the huge drop. It even reached 2,320 USD/oz on the 11th of June and it is currently settled near that level.

______________________________________________________________

______________________________________________________________

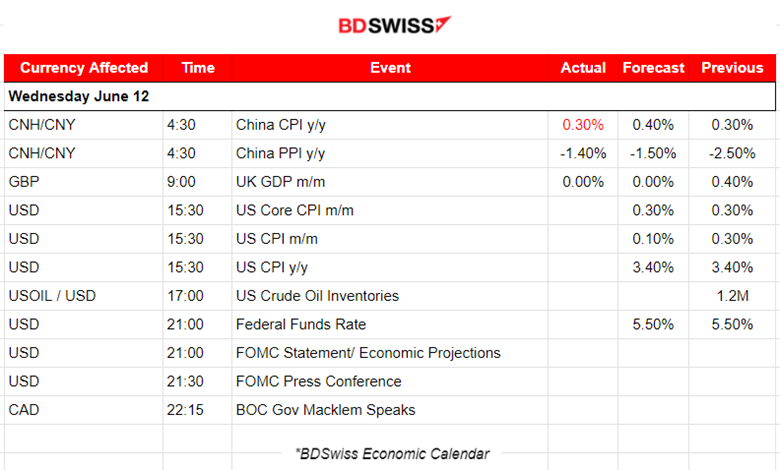

News Reports Monitor – Today Trading Day (12.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s CPI inflation dropped in May, and PPI declined at a slower pace. CPI rose 0.3% year-on-year in May. Month-on-month CPI inflation shrank 0.1%. CNH saw appreciation, however, and USDCNH dropped at the time of the release.

- Morning – Day Session (European and N. American Session)

Monthly real gross domestic product (GDP) is estimated to have shown no growth in April 2024. GDP is estimated to have grown by 0.7% in the three months to April 2024. GBP saw depreciation and GBPUSD dropped around 10 pips before a full reversal.

At 15:30 the most important news of the week takes place. The CPI data for the U.S. will confirm if wages and increased labour kept prices high. The USD pairs are expected to experience an intraday shock. If the figure is reported higher, then the USD should obviously jump upon release as it will indicate delays in Fed rate cuts.

At 21:00 the Fed will decide if an interest rate policy change is appropriate. It is widely expected that rates will remain steady. However, statements from the FOMC could increase volatility or push for the USD to be affected for longer than usual.

General Verdict:

______________________________________________________________