Market Analysis Review

Australia’s employment more than expected, U.S. PPI weaker than expected, U.S. unemployment claims jumped, U.S. Dollar remained strong

Previous Trading Day’s Events (13.06.2024)

The producer price index for final demand dropped 0.2% last month after advancing by an unrevised 0.5% in April.

The U.S. central bank on Wednesday kept its benchmark overnight interest rate in the current 5.25%-5.50% range, where it has been since last July.

Also on Wednesday, Fed officials pushed out the start of rate cuts to perhaps as late as December, with policymakers projecting only a single quarter-percentage-point reduction for this year.

Source: https://www.reuters.com/markets/us/us-producer-prices-unexpectedly-fall-may-2024-06-13/

______________________________________________________________________

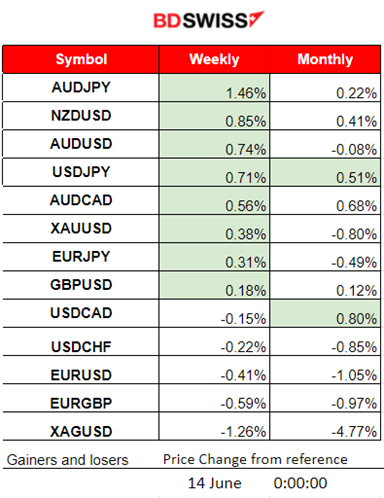

Winners vs Losers

AUDJPY is leading for the week with 1.46% gains so far. AUD pairs (AUD as Base) have reached the top of the list. The USD reversed fully this week by appreciating while the EUR depreciated causing EUR pairs (EUR as base) to remain at the bottom. Silver is losing for 2 consecutive weeks now.

______________________________________________________________________

______________________________________________________________________

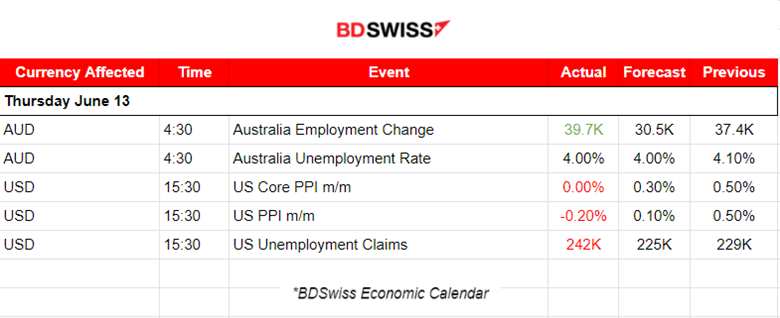

News Reports Monitor – Previous Trading Day (13.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s employment change was reported higher than expected at 39.7K versus the expected 30.5K, while the jobless rate fell by 0.10% as expected. These data show how strong the labour market conditions are and indicate that inflation has lower chances of lowering, despite the fact that the central bank raised interest rates in 2023 to 4.35%, keeping it high until now. Policy easing is only likely to begin in the second half of 2025, according to former senior Reserve Bank official Jonathan Kearns.

The market reacted with AUD appreciation but the effect soon reversed, marking a low-level intraday shock. AUDUSD jumped just 12 pips before reversing.

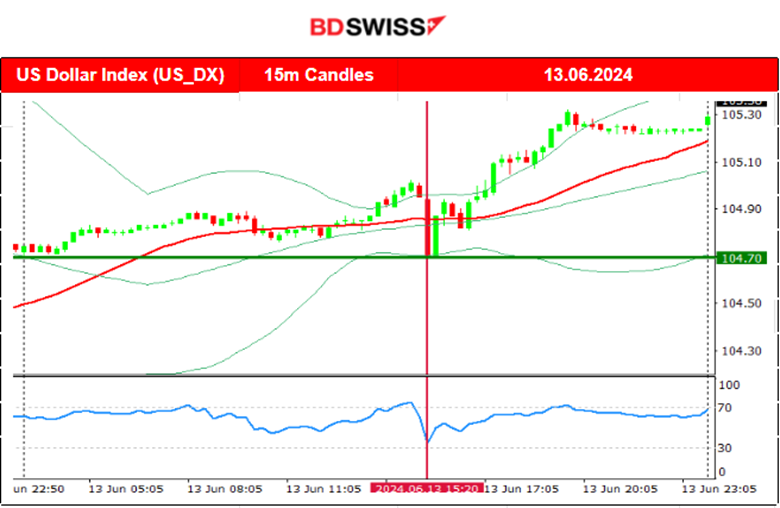

- Morning – Day Session (European and N. American Session)

At 15:30 the U.S. PPI data were reported weak as expected with even worse figures. Jobless claims were reported higher than expected, up to 242K. These are the highest initial claims numbers since August last year. The rising jobless claims and worsening PPI data support the view that rate cuts are on track. The market reacted with depreciation of the U.S. dollar at the time of the release. However, the effect faded soon as the dollar experienced appreciation soon after the release lasting until the end of the trading day.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (13.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving to the downside quite steadily as the USD was appreciating with volatility starting to pick up as we moved closer to the start of the European session. Then upon the release of major news, PPI and Jobless claims for the U.S. the dollar suddenly depreciated following the weak PPI figures and strong claims figures but only momentarily. The pair reversed soon as the USD started to appreciate heavily while the EUR started weakening instead causing the pair to drop heavily without any retracement to take place during the trading day. Critical support is now 1.07220.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

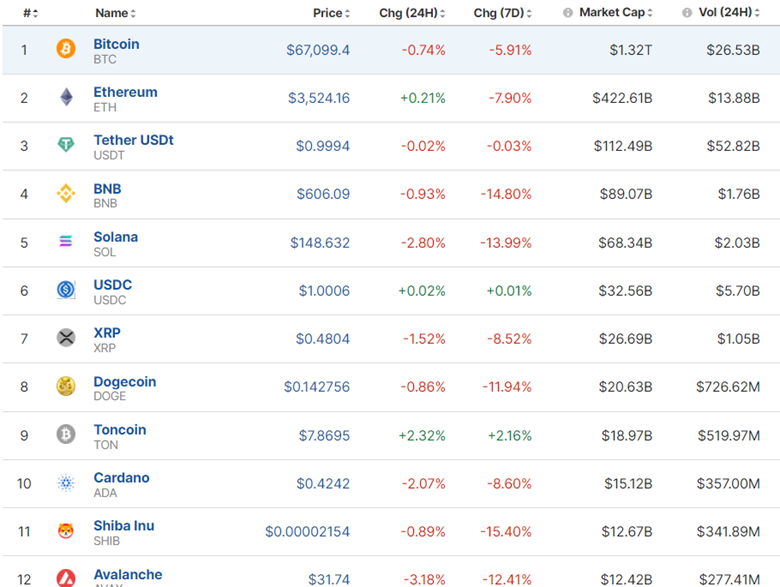

After some consolidation that lasted since the 11th of June, the price eventually crashed further, reaching a support near 67,200 USD. The price eventually retraced to the 61.8 Fibo level and settled at near 67.5K USD. On the 12th of June, the U.S. CPI news caused dollar depreciation and Bitcoin jumped to test again the 70K USD resistance. It was however unsuccessful and reversed to the 30-period MA. Volatility levels lowered but the price returned near the 67K USD support. On the 13th of June, the price tested the support without success and it reversed. Currently, volatility has lowered and the price remained close to the 67K USD level.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market remains inactive after prices lowered this week.Volatility is lower. Next week we might see some more activity.

Source:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 10th of June, the index moved sideways but with moderate volatility and with several unsuccessful tests for a breakout of the resistance at near 5,373 USD. It was a consolidation phase that was broken to the upside on the 12th of June when finally the index moved higher. At 15:30 the U.S. CPI news caused the index to jump as inflation was reported lower than expected. This gave a hint that interest rates, and borrowing costs, could lower soon. After reaching resistance at near 5,450 USD the index retraced near 5,420 USD and continued sideways. The sideways path continued to the 13th of June as volatility lowered. The U.S. news that day had not much impact. A triangle formation is now visible with resistance at 5,450 USD. The 5,400 USD level could be reached again upon a triangle breakout to the downside.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 12th of June, the resistance mentioned in our previous analysis was broken as predicted and the price moved higher. However, the U.S. inventories report released the same day at 17:30 had a negative impact on the price. Technically, that 79 USD level resistance looks like a turning point. On the 13th of June, the pierce remained on a sideways path despite the volatility, forming a triangle currently. Its breakout to either direction could cause rapid movements. The target level upon downward breakout could be 76.6 USD/b while 79 USD/b is acting as important resistance at the moment.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 12th of June, the U.S. CPI news caused the USD to depreciate and Gold to jump. After a jump of almost 30 dollars, it reversed when it found resistance at near 2,342 USD/oz. The reversal was quick. The dollar had not yet appreciated enough but the reversal started to happen indicating demand perhaps weakening, keeping the metal lower. On the 13th that view was confirmed as the price moved even lower. After reaching the support at 2,295 USD/oz the price retraced to 2,311 USD/oz, which acted previously as support, and settled currently there.

______________________________________________________________

______________________________________________________________

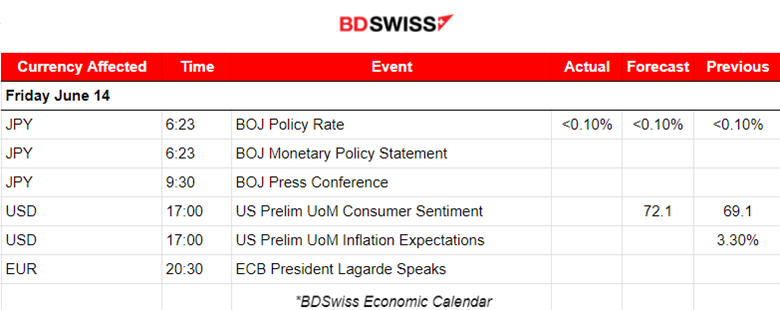

News Reports Monitor – Today Trading Day (14.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) decided, by a unanimous vote, to set the following guideline for money market operations for the intermeeting period: The Bank will encourage the uncollateralized overnight call to remain at around 0 to 0.1%. Regarding the purchase of Japanese government bonds (JGBs), CP, and corporate bonds for the intermeeting period, the Bank will conduct the purchase in accordance with the decisions made at the March 2024 MPM. They decided to decrease bond purchases. The market reacted with JPY depreciation during that time. USDJPY jumped over 90 pips.

- Morning – Day Session (European and N. American Session)

At 17:00 the USD pairs could see an intraday shock from the release of the UoM Preliminary U.S. consumer sentiment and inflation expectations reports. If consumers are confident about the future and have higher inflation expectations then the USD should remain strong. The labour market so far shows that it is strong enough for consumers to form such expectations. However, the inflation data, both the CPI and PPI were reported to weaken.

General Verdict:

______________________________________________________________