Market Analysis Review

U.S PMI up to 47.2, AUDJPY falls 2.14%, BoC Rate Decision forecast 4.25% today

Previous Trading Day’s Events (03.09.2024)

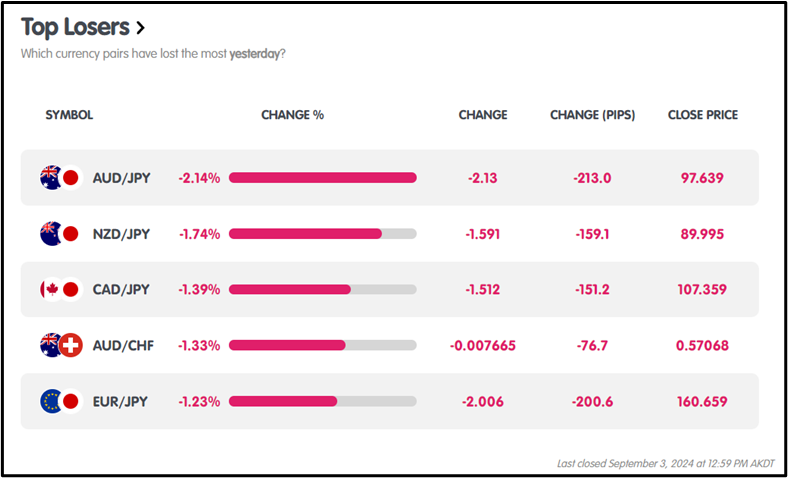

Switzerland Inflation MoM: Consumer prices remained flat in August 2024, missing expectations of a 0.1% uptick, after a 0.2% drop in July.

Switzerland GDP Growth: GDP expanded by 0.7% in Q2 2024, outpacing forecasts and Q1’s 0.5% growth, driven by a 2.6% surge in manufacturing.

US ISM Manufacturing PMI: PMI inched up to 47.2 in August 2024 from 46.8, underperforming expectations of 47.5, marking the 21st contraction in 22 months.

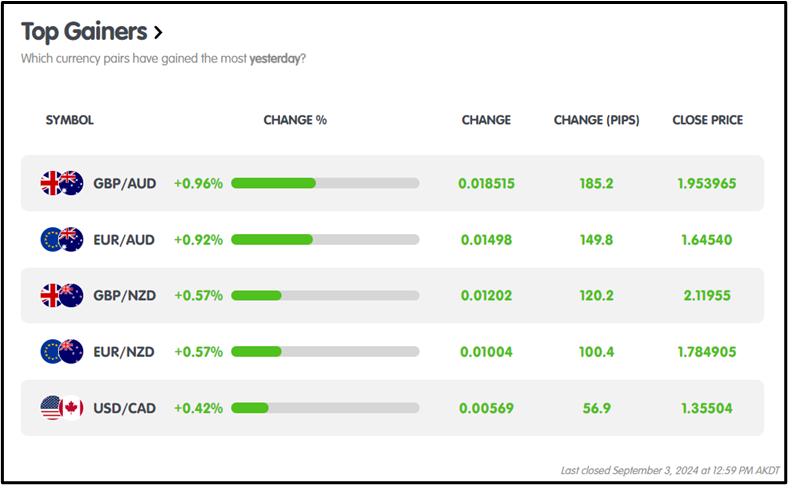

Winners and Losers In The Forex Market

On September 3, 2024, in the Forex Market, GBPAUD led the gainers with a 0.96% increase, equating to 185.2 pips, while AUDJPY trailed as the top loser with a 2.14% decline, reflecting a loss of 213 pips.

On September 3, 2024, in the Forex Market, GBPAUD led the gainers with a 0.96% increase, equating to 185.2 pips, while AUDJPY trailed as the top loser with a 2.14% decline, reflecting a loss of 213 pips.

News Reports Monitor – Previous Trading Day (03.09.2024)

Server Time / Timezone EEST (UTC+03:00)  Tokyo Session: No significant news.

Tokyo Session: No significant news.

London Session:

CHF exhibited a bullish trend at 6:30 am GMT as inflation remained flat at 0%, underperforming the 0.1% forecast and improving from July’s -0.2%.

CHF turned bearish at 7:00 am GMT despite Q2 GDP growth of 0.7%, surpassing the 0.5% Q1 figure and forecasts, supported by a 2.6% rise in manufacturing.

New York Session:

USD showed bullish behaviour at 14:00 pm GMT as the ISM Manufacturing PMI increased to 47.2 from 46.8, falling short of the 47.5 forecast but continuing a 21-month contraction streak.

General Verdict:

FOREX MARKET MONITOR

EURUSD (03.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EUR/USD showed a bearish trend, opening at 1.10664, hitting a high of 1.10723, dropping to a low of 1.10256, and closing lower at 1.10424.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (03.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD traded bearishly, opening at $58,975.25 and closing lower at $58,199.98, with intraday volatility between a low of $57,538.23 and a high of $59,794.65.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

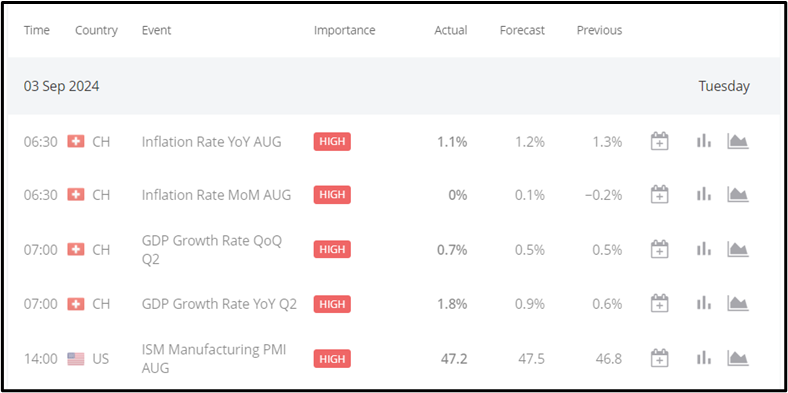

TESLA (03.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Tesla showed overall bearish momentum, opening at $217.55, hitting a high of $218.86, dipping to a low of $208.62, and closing at $209.63.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

S&P 5OO (03.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The S&P 500 opened at 5662.96, hit a high of 5662.98, dipped to a low of 5511.56, and closed bearish at 5527.50.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

XAUUSD (03.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

XAUUSD showed overall bearish momentum, opening at $2499.47, hitting a high of $2506.16, dipping to a low of $2473.04, and closing weaker at $2492.48.

News Reports Monitor – Today Trading Day (04.09.2024)

News Reports Monitor – Today Trading Day (04.09.2024)

Tokyo Session:

Tokyo Session:

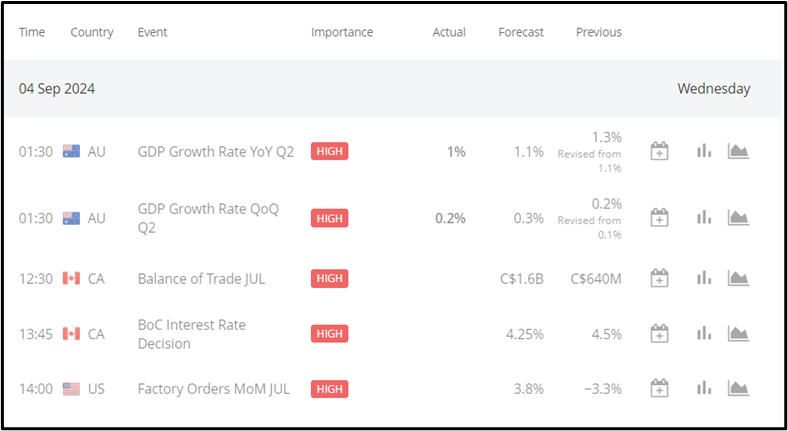

Australian GDP YoY, 1:30 AM, Bullish AUD (Actual: 1%, Forecast: 1.1%)

Australian QoQ GDP, 1:30 AM, Bullish AUD (Actual: 0.2%, Forecast: 0.3%)

London Session: No Significant News

New York Session:

Canadian Balance of Trade, 12:30 PM, Bullish CAD if (Actual > Forecast)

BoC Rate Decision, Time: 1:45 PM, Bullish CAD if (Actual > Forecast, Forecast: 4.25%)

US Factory Orders MoM, 2:00 PM, Bullish USD (Actual > 3.8% Forecast)

General Verdict:

Source: